PeopleForBikes approached SmartEtailing for help in providing timely insights into retail sales. They want to offer suppliers a dashboard to monitor retail trends at this critical time to adjust forecasts accordingly.

We chose to volunteer data in a private and secure way - intending to keep suppliers informed and help you have adequate stock. We also want to show suppliers that independent dealers are capable of meeting online consumer needs.

Index methodology

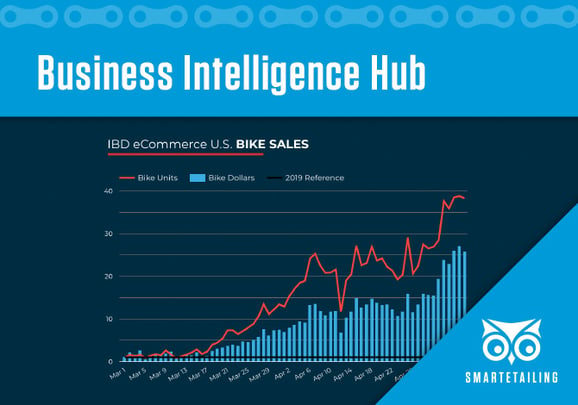

We published the IBD ecommerce index with PeopleForBikes using an index so we can share relative changes on a daily basis - without revealing actual results. This index uses SmartEtailing platform data, not individual retailer data.

This index shows percent change relative to 2019 for each date on the SmartEtailing ecommerce platform. A value of "0" indicates the online sales for that date had zero growth over 2019. As a practical example, on March 19, 2020 US bike sales dollars were up 202% compared to the same date in 2019.

No Comments Yet

Let us know what you think